Sterling and Wilson Swings to Q1 Profit on Strong Domestic EPC Demand

The company reported Q1 FY 2025 profit of ₹50 million

July 19, 2024

The engineering, procurement, and construction (EPC) arm of Shapoorji Pallonji Group, Sterling and Wilson Renewable Energy, posted a net profit of ₹50 million (~$600,000) in the first quarter of the financial year (FY) 2025, swinging from a net loss of ₹950 million (~$11.4 million) in the same quarter last year. This marks the second consecutive quarter of profit for the company.

The bottom line was helped with revenue growth of 78% year-over-year (YoY), reaching ₹9.15 billion (~$109.8 million) in the quarter, up from ₹5.15 billion (~$61.8 million).

The revenue growth was primarily driven by higher execution in domestic EPC projects, contributing ₹8.32 billion (~$99.8 million) to the total revenue. International EPC operations generated ₹260 million (~$3.1 million), while the Operations and Maintenance segment added ₹570 million (~$6.8 million) to the top line.

The improvement in financial performance can be attributed to its strong growth in domestic EPC operations, which saw a YoY increase of 61.6%. However, international EPC operations continued to face challenges, showing a decline from the previous year.

The company maintained gross margins at 11.1% in Q1, slightly down from 11.3% last year.

Earnings before interest, tax, depreciation, and amortization (EBITDA) also turned positive to ₹370 million (~$4.4 million) in Q1 from negative EBITDA of ₹340 million (~$4.1 million) reported in the same quarter last year.

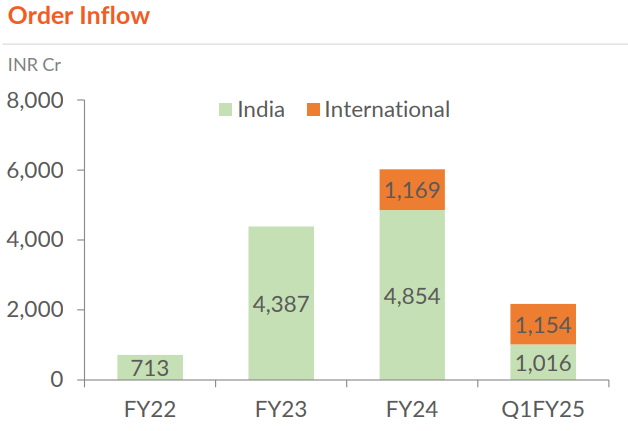

The company’s order book also continued to grow, with the unexecuted order value standing at ₹93.96 billion (~$1.13 billion) as of June 2024, up from ₹80.84 billion (~$970.1 million) in March 2024. During the quarter, the company received new orders and Letters of Intent totaling ₹21.70 billion (~$260.4 million), further bolstering its future revenue visibility.

Helped by falling module prices, the company posted its first profit last year after nearly 12 quarters in Q4 2024.

Last December, the company raised ₹15 billion (~$180.03 million) through Qualified Institutions Placement.