Power-Hungry Data Centers Drive Demand for Renewable Energy in India

Power demand from data centers reached 139 billion kWh in June 2023

August 2, 2024

With over 880 million internet users and a thriving tech sector, India’s data center industry has seen explosive growth in recent years and is poised to accelerate with the advent of artificial intelligence. This expansion, however, comes with a significant electricity demand, straining the country’s already stressed power grid.

Power demand from data centers in India grew at 4.4% year-on-year to reach 139 billion kWh in June 2023, according to Rohan Sheth, Vice President, Colocation & DC Build at data center company Yotta.

Meanwhile, the International Energy Agency (IEA) estimates that by 2030, data centers alone will consume about 8% of total energy globally. Data centers currently consume about 1-1.5% of global energy and contribute to 0.3% of global emissions.

A Booming Industry

“The Indian data center market has grown from 2.7 million square feet in 2017 to 11 million square feet in 2023,” said Sheth of Yotta, adding that capacity has increased by 100 to 150 MW annually in recent years, reaching nearly 900 MW by 2023.

This growth shows no signs of slowing, with projections suggesting India’s data center capacity could cross 1,800 MW by the end of 2026.

“The country boasts a substantial capacity of approximately 950 MW, surpassing other major countries like Australia, Hong Kong SAR, Japan, Singapore, and Korea. It is further set for significant expansion with an anticipated addition of around 850 MW between 2024 and 2026,” said Prashant Goyal, Head of Data Centre Practice at CBRE-India.

Several factors are driving this expansion, according to Xavier Surentherathas, Senior Director, APAC Channel Sales at Park Place Technologies – a data center maintenance firm. Global cloud providers like Amazon Web Services, Microsoft Azure, and Google Cloud are increasing their presence in India to meet the rising demand for cloud services. Government initiatives, such as granting infrastructure status to data centers and introducing supportive policies, have also played an important role.

“The enactment of the Digital Personal Data Protection Act in 2023 has promoted secure cross-border data exchange, lawful data processing practices, and heightened confidence among stakeholders,” said Goyal.

The Energy Challenge

This rapid growth, however, comes with a significant energy demand. Data centers currently account for about 2% of India’s total power consumption, a figure that is expected to rise, said Surentherathas.

“Data centers, by nature, consume large amounts of energy given the IT infrastructure they run and support,” said Sheth.

Currently, most of India’s electricity is derived from coal, which contributes around 75% of the country’s power generation. This heavy reliance on fossil fuels poses a challenge to the sustainability of the data center industry, but companies have set ambitious targets to procure more from renewable sources, driving up demand for clean energy.

For instance, CBRE aims to transition its corporate operations to 100% renewable energy by the end of 2025. “Currently, we are working towards meeting our energy demands with a balanced approach between fossil fuels and renewables, with a clear focus on increasing the percentage of renewable sources over time,” said Goyal.

Earlier this year, telecommunications service provider Bharti Airtel‘s data center subsidiary Nxtra said it would procure 140 GWh of renewable energy annually for its data centers in Tamil Nadu, Uttar Pradesh, and Odisha. The company partnered with AmpIn Energy and Amplus Energy to set up captive solar and wind power projects totaling 72.3 MWdc capacity to power its data centers under 25-year agreements.

AdaniConneX, a data center solutions provider and a joint venture between Adani Enterprises and EdgeConneX, raised $1.44 billion earlier this year to fund its renewable energy-powered data centers. The company plans to build an environmentally and socially conscious 1 GW data center infrastructure platform.

Last year, Akhil Agarwal, Senior Director, Power Management, ST Telemedia Global Data Centres (STT GDC), had told Mercom in an interview, “Our facility load is 400 MW across 21 operational data centers in 10 Indian states. We are adding 1-2 data centers every year.”

According to its ESG report, renewable energy accounted for 62.5% of STT GDC’s electricity consumption in 2023, far earlier than its target to achieve 60% by 2026. The company is sourcing renewable electricity through onsite installations, green tariffs, power purchase agreements, energy attribute certificates, and offsets.

A developer told Mercom that his company recently commissioned three solar projects in Uttar Pradesh, where CtrlS procures power to operate its data centers. The developer has also signed contracts with other Karnataka and Andhra Pradesh data center companies.

“The data center market requires huge capacities of power. Overall, the market size of data centers is roughly 8 GW by 2025, and by 2030, we require 20 GW of solar power for data centers,” he said.

“Several data centers powered by alternative sources stand as leading Indian examples, with over half of their power currently derived from renewable energy sources. A fully 100% contained solar-powered data center is currently under construction in Uttar Pradesh. A new captive solar power plant is being developed to meet the energy requirements of other new core and edge data centers in the state,” said Surentherathas.

Impact of Artificial Intelligence

According to the IEA, a single ChatGPT query uses 2.9 watt-hours of electricity compared to 0.3 watt-hours for a Google search, underscoring the energy-intensive nature of large language-based models that underpin artificial intelligence in use today.

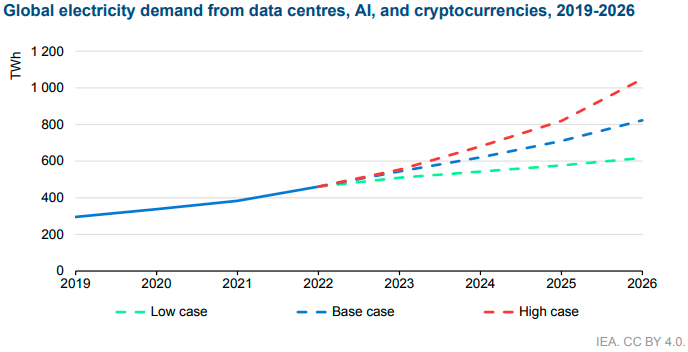

Meanwhile, Goldman Sachs Research projects that AI will increase data center power consumption by 200 TWh annually between 2023 and 2030, with AI accounting for about 19% of data center power demand by 2028.

Sustainability Initiatives

Electricity demand in data centers primarily comes from two main processes: computing and cooling. Computing accounts for about 40% of a data center’s electricity demand, while cooling, necessary to maintain stable processing efficiency, also makes up approximately 40%. The remaining 20% is used by other associated IT equipment.

Integrating renewable energy can help reduce a data center’s carbon footprint and increase energy efficiency. Companies are focusing on improving Power Usage Effectiveness (PUE), a key metric for energy efficiency in data centers.

Yotta, for example, reports a PUE of 1.4, which is considered good for a tropical climate like India’s.

STT GDC reports that in 2023, their operating PUE was 1.5 compared to 1.66 in 2020.

Advanced cooling technologies, such as liquid immersion and adiabatic chillers, are also being deployed to reduce energy consumption for cooling, a major power draw in data centers, according to the companies Mercom spoke to.

Some operators are also exploring ways to capture and reuse excess heat generated by data centers, potentially providing a renewable energy source for nearby buildings or industries.

Ravichandran Purushothaman, President of Danfoss India, emphasizes the potential for heat reuse. “By harnessing excess heat, we’re not only reducing energy consumption but also creating a reliable source of clean energy.”

The company recently partnered with Hewlett Packard Enterprise to deliver an off-the-shelf heat recovery module to help it manage and value excess heat.

Despite these efforts, challenges remain. Industry experts pointed out several barriers to renewable energy adoption, such as the intermittency of renewable sources like solar and wind, as data centers require an uninterrupted power supply. They also said that current regulations do not allow data centers to bank excess power generated during peak times for use during non-peak periods.